An introduction to Online Advertising, and why you should care (英文原文)

感谢 Sarah Long 翻译

1994年,Wired(即后来的HotWired)宣布发明了Banner广告。

同年,Mosaic浏览器发展成为Netscape。如果你觉得今天太多的广告影响了页面加载速度的话,不妨想想当年吧:用户需要用小猫拨号连接互联网,下载页面上方的Banner广告,才能看到页面的正式内容。

尽管存在很多不足,468×60像素的Banner广告果“不负众望”地成功进军互联网。HotWired为包括MCI, Volvo, Club Medt和Zima在内的14家公司推出了Banner广告,但传言HotWired的第一个广告来自AT&T。

Banner广告引发了互联网的第一次“大爆炸”。作为Wired杂志的数字支脉,HotWired的发展很快超过了其杂志部门,HotWired大力招揽员工,推出搜索引擎HotBot,年收入逾2000万美元。随着风险投资的不断增加,Banner广告对门户战争起到了推波助澜的作用。

到90年代末,网络广告成为互联网的首选营销手段。1998年,一家名为goto.com的公司(即后来的Overture,2003年被Yahoo收购),开始提供基于关键字文本的广告形式。自此,搜索营销诞生。

作为在线营销的有力竞争者,Google突袭搜索广告领域,直接威胁到展示广告的霸主地位。在过去的十年中,Google搜索广告的收入高达数十亿美元。近年来,Google进军展示广告,并成功击败Yahoo成为美国最大的展示广告商。

最近有报道称,AOL, Microsoft和Yahoo已达成协议,计划对Google的在线广告施加压力。Google展示广告副总裁Neal Mohan在最近的iAB Future of Display会议上称,未来几年的网络广告收入将从2010年的250亿美元增加到2000亿美元。

从Facebook,The Next Web等网站上得到的服务真的是免费的吗?当然不是。如果用户不需要为享有的服务买单,那用户本身就是商家待售的产品。文字广告击败分类广告,展示广告击败平面广告,视频广告击败电视广告。这类靠鼠标点击推动的网络广告到底是怎么运作的呢?

首先,绝大多数的广告商都会寻找一个干净适合的广告环境,也就是没有色情内容的出版商。同时,出版商也会通过与生声誉良好的广告商合作赚取一定的收入。当然,供广告商买和出版商卖的选择都很多,因此,这看似简单的事情其实一点也不简单。

随着数十家既为广告商又为出版商提供服务的广告网络公司相继涌现,一种新的广告形式出现了——广告交易(Ad Exchange)。广告交易为广告商提供对在线库更直接的访问和控制。每个广告交易都有两方——买方和卖方,也就是所谓的需求方和供应方。随着2007年Yahoo 收购RightMedia Exchange (RMX),2009年Google推出DoubleClick ad exchange (AdX),广告交易已极大地影响了主流媒体。

随着广告网络规模的不断壮大,现在很多的广告网络关注更多的是如何赚钱,而很少顾及出版商的利益。这类网络通常被称为“黑盒子”。

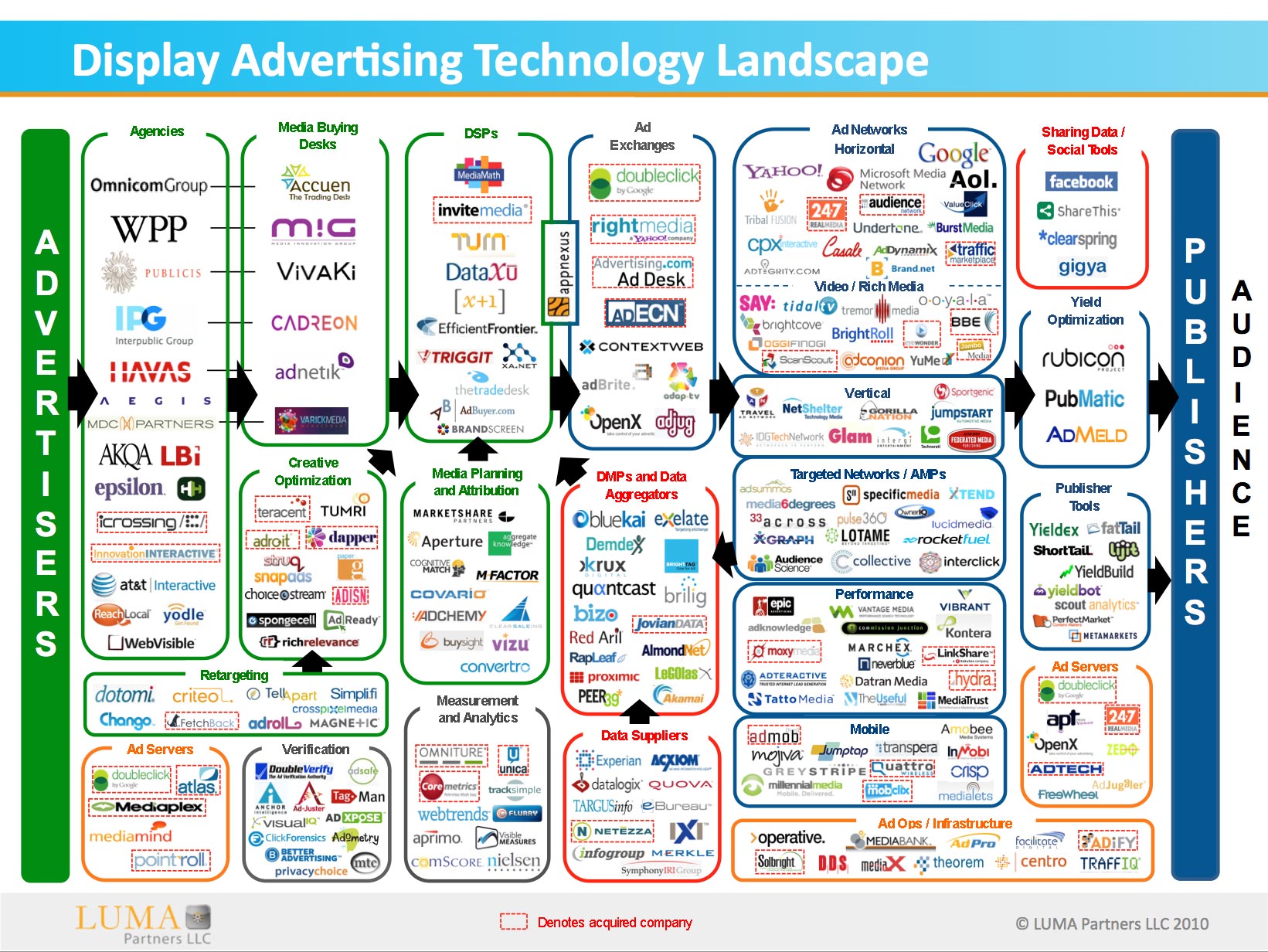

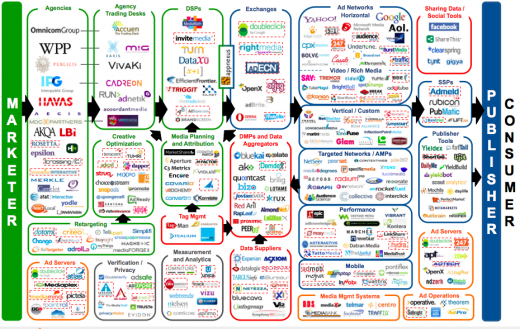

为增加对广告商的透明度和对出版商的质量保障,已涌现出了数十家的小型中介公司。通过下面的分布图,可以看到网络广告当前生态系统的大致情况:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

原文:

In 1994, Wired, then known as HotWired, claims it invented the banner ad.

The Mosaic browser was just morphing into Netscape in 1994. And if you think ads slow down page loads now, readers had to download the first banner ads over thin dial-up connections.

Despite those handicaps, the gaudy banner ad took over the web, 468 pixels wide by 60 deep. HotWired launched with banner ads from 14 companies including MCI, Volvo, Club Med, 1-800-Collect and Zima, but legend has it that the first HotWired banner ad was from AT&T, prophetically asking “Have you ever clicked your mouse right here? You will.”

The banner ad powered the web’s first explosion. HotWired, a digital offshoot of Wired magazine, soon had more employees than the magazine, launched a search engine (HotBot) and was pulling in $20 million a year in revenue. The banner ad fueled the portal war, as startups ranging from Kozmo to Pets.com poured millions of venture capital dollars to lure net users and secure the elusive “early mover advantage.”

By the late 90s, online advertising emerged as the Web’s premiere marketing vehicle. Then in 1998, a company named goto.com–later Overture, which was bought by Yahoo! in 2003– began offering text-based ads targeting keywords, and search marketing was born.

Google’s foray into the space solidified search as a serious contender for online marketing dollars, threatening display’s dominance. For the past decade, Google has raked in billions of dollars from its search advertising revenues. And in recent years, Google has moved aggressively into display ads to oust Yahoo as the biggest display ad player in the U.S.

We recently reported that AOL, Microsoft and Yahoo have teamed up to form an ad pact to take on Google in the online advertising game. Why should you care about all of this? This game economically powers the Internet that you enjoy. While the Internet’s bubble may have popped in 2000, at the most recent iAB Future of Display conference, Neal Mohan, VP of Display Advertising at Google, declared that online advertising spending will rise from $25 billion in 2010 to $200 billion in the next few years.

All those great services and sites–everything from Facebook to The Next Web that you think you’re getting for free? Think again. If you don’t pay for a service, you’re the product. Text-based ads killed classifieds. Display ads killed print advertising and video is about to kill TV Ads. So, let’s lay out the basics of how this real-time, optimized, demand side, sell side, exchange, networked, eyeball, click-driven landscape operates.

First, most advertisers are looking for reach in “well-lit” areas and brand-safe environments, aka publishers without porn. And publishers are looking for dollars from advertisers that don’t harm their brand either. It starts to get complicated because there are so many places for advertisers to buy and for publishers to sell.

After dozens of Ad networks popped up to help marketers run display ad campaigns with web publishers, a new kind of industry inventory consolidator emerged: In 2005, the Ad Exchange was born to provide advertisers with more direct access and control over available online inventory. There are two sides to an Ad exchange-a buy side and a sell side, also known as demand side and supply side, respectively. Ad exchanges hit mainstream media when Yahoo acquired the RightMedia Exchange (RMX) in 2007 and Google launched the DoubleClick ad exchange (AdX) in 2009. Both exchanges help ad networks, agency holding companies, and third-party technology providers maximize their return on investment (ROI) across millions of sites.

But as Ad networks grew in size such as Collective Media, Blue Lithium (bought by Yahoo), Ad.com (bought by AOL in 2004) and Specific Media (which just bought MySpace), they cared more about making money in any way possible and less about the publisher. Ad networks of this size were referred to as “the black box.”

To increase transparency for the advertiser and quality for the publisher, dozens of smaller intermediary companies sprung up at various points on the buy/sell scale, distinguishing themselves as either DSPs or SSPs with better tailored and targeted technologies. A SSP aka Sell Side Platform or Supply Side Platform is a technology platform for publishers to manage their ad inventory and increase revenue by tapping into the different sources of available advertising income. Companies that offer these services include AdMeld, PubMatic and The Rubicon Project. Many of the world’s larger web publishers including Weather.com, NBC Universal, CBS Interactive, Fox News and QuadrantOne use a Sell Side Platform to automate and optimize the selling of their online media space. This June, Google made the industry’s first supply side platform acquisition of AdMeld.

A DSP aka Demand Side Platform is a similar technology to SSP where buyers seek online advertising inventory and the exact target audience. While SSP is a technology solution for a publisher, the DSP is a tech solution for advertisers. The two integrate with each other to buy and sell online media inventory. Companies that offer these services include InviteMedia, Turn, MediaMath and DataXu.

Take a look at the current landscape below to understand just how diverse the space has become:

(Click to enlarge)

When you try to figure out how these companies are making money on the Internet, it can feel like entering a labyrinth of acronyms. Like any big money making business (legal, medical, financial, etc.), online advertising is shrouded in jargon and industry speak. It’s the Internet’s version of the Wall Street jive. These words are meant to trip you up and spin you around, so make sure to become familiar with these acronyms so you don’t get lost in the land of double talk.

CPM: Cost per impression; the cost of an online advert per thousand views. The M stands for the Roman Numeral representing 1,000. For example, in banner advertising you pay for each 1,000 ad views your banner receives.

So CPM = C=Cost P=Per M=1,000.

CPC: Cost per click; aka PPC: Pay per click; this is an online advertising model used to direct traffic (human eyeballs) to websites, where advertisers pay the publisher (website owner) when the ad is clicked. Among CPC/PPC providers, Google AdWords, Yahoo! Search Marketing and Microsoft adCenter are the 3 largest network operators, and all 3 operate under a bid-based model. That means that advertisers paying these sites typically bid on keyword phrases relevant to their target market. So if you’re a social media consulting firm, you would bid on search terms like “social media” “social networking”, “social media consulting”, etc.

CPL: Cost per lead; is an online advertising model in which the advertiser pays for an explicit sign-up from a consumer interested in the advertised offer. In contrast to the aforementioned models, advertisers only pay for qualified sign-ups making CPL pricing models the holy grail of the online advertising ROI hierarchy.

CPA: Cost per action; an online advertising pricing model, in which the advertiser pays for each specified action (a purchase, a form submission, etc) linked to an advertisement. As opposed to brand marketing, direct response advertisers consider CPA the optimal way to buy online advertising, as an advertiser only pays for the ad when the desired action has occurred.

CPA is sometimes referred to as “cost per acquisition“, which typically has to do with acquiring new customers with advertising. Using the term “cost per acquisition” instead of “cost per action” is not incorrect in such cases, but not all “cost per action” offers can be referred to as “cost per acquisition“.

RTB: Real Time Bidding; is the buying and selling of ad impressions, in realtime in the online marketplace.

DMP: Data management platform; forms the data backbone of all advertising operations. Think of DMPs as a cross between ad servers and customer relationship management platforms. The DMP provides the plumbing infrastructure to route, process, aggregate, log, store, and report on billions of points of advertising related data every day.

There are no doubt a handful of other acronyms and terms we’ve left off the list for now. The one thing you have to remember is that everyone in this ecosystem is taking a sizable cut. And who you make money from today might not be who make you money in the future. You have to continue to test your options.

Fragmentation is a natural part of the advertising business. There used to be 3 TV networks and if you wanted to reach a large audience, you picked up the phone and called one of those 3 companies. Now you have thousands of options. You can’t find large audiences any more. You have to follow your users as they play an iPhone game, then watch TV as they browse on their laptop.

To be fair, fragmentation is a natural part of any business. Innovation is messy and it can take a while to determine which companies are just smoke and mirrors. But if Google has its way, it will create a one stop place where an advertiser can reach anyone on the Internet through one interface and not have 350 companies on that image you saw above. This will be good for Google. And probably good for you too. As long as you are okay living on the planet Google Earth.

And as an online journalist, I thank you kindly for your clicks.

Image Source: Shutterstock/koya979/nmedia

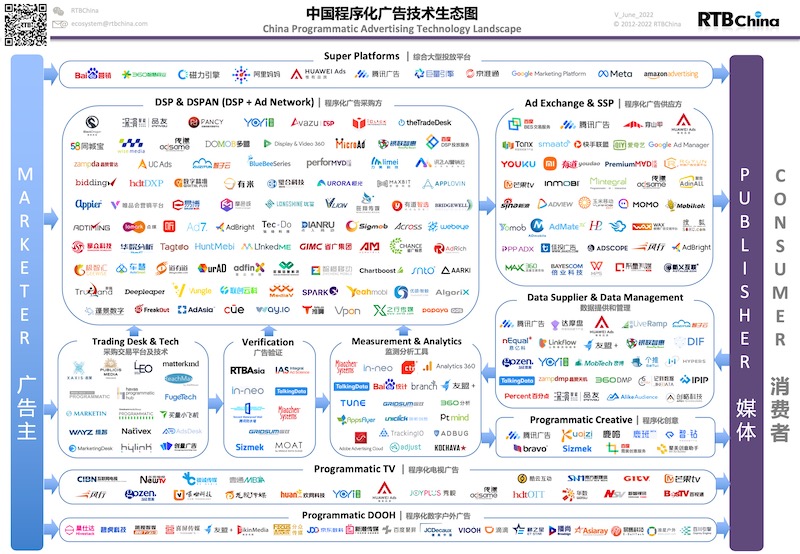

RTBChina

RTBChina