[AdExchanger News, April 2012] Xuehua Shen is CTO and Co-Founder of iPinyou, a demand-side platform technology company based in China. Shen discussed his company and its recently announced demand-side platform with AdExchanger earlier this month. He covered the following topics:

[AdExchanger News, April 2012] Xuehua Shen is CTO and Co-Founder of iPinyou, a demand-side platform technology company based in China. Shen discussed his company and its recently announced demand-side platform with AdExchanger earlier this month. He covered the following topics:

- Display In China

- iPinyou’s Demand-Side Platform

- Guaranteed Vs Non-Guaranteed

- Sourcing Display Supply

- Milestones Ahead

AdExchanger: How has audience buying in the display media space in China progressed compared to the rest of the world?

XS: Audience buying is ready for prime time in China after several years’ market growth. I can elaborate on this from three perspectives:

1) Demand. Many marketers and advertisers such as P&G China and auto advertisers have become very sophisticated about digital advertising and ask for audience buying services. iPinyou receives a strong demand for audience buying right now.

2) Technology. Some companies, such as iPinyou, have built infrastructure over the years for audience buying. That infrastructure includes a scientific and structured taxonomy, large-scale data storage and computation, user profile mining expertise, and scalable targeting technology during ad serving.

3) Pricing. Advertising models in China are steadily changing from CPT (Cost Per Time) to CPM, CPC, and CPA. Not only does iPinyou push hard on impression-by-impression buying, but we make innovative pricing models by combining impression with audience attributes for sophisticated advertisers.

Recently, you announced the launch of a demand-side platform (DSP) in China. First, any quick thoughts on what the key components of a DSP are in your estimation?

At an ad exchange forum held in Beijing in October 2011, I gave a speech about DSPs. I believe a DSP should have two key components: real-time bidding and data-driven audience targeting. Without RTB, we miss a impression opportunities. Without data-driven audience targeting, we could not take full advantage of optimization opportunities brought by RTB. Besides real-time bidding and data-driven audience targeting, a nice user interface and multi-dimensional reporting for advertisers are also important.

What is your company’s target market? Agencies? Direct marketers? China-only?

iPinyou clients include both direct marketers and agencies (4As and domestic agencies). We are laser-focused on opportunities in China now.

Is this your own technology or do you license? Can you talk a little bit about the team on your end?

So far, we build our products – including Optimus, an audience targeting ad serving and optimization platform, and Folo8, a social ads product with incentives – in-house by fully leveraging open-source tools. But we will not develop all tools on our own and are eager to explore opportunities to partner with other technology vendors – U.S. vendors in particular – and bring cool advertising products to China. IPinyou has built one of the best engineering teams in the ad technology space. Half our staff is in R&D. They have expertise in data mining, cloud computing, highly scalable serving and optimization, front-end optimization, and user interface design.

Regarding supply, guaranteed vs. non-guaranteed media – any trends you can report in China?

Right now audience-buying inventory, including RTB-enabled ad exchange inventory, starts with non-guaranteed media. Not much premium media has been put on the ad exchange to-date. Most premium inventory is sold through direct sales teams at large publishers. But premium inventory is steadily moving to exchanges. From the start, iPinYou is dedicated to working with publishers on a non-guaranteed basis, and giving publishers a high premium. This will allow better utilization of the targeted impressions.

How will the launch of the DoubleClick Ad Exchange in China affect your business?

It is hugely positive for us. DoubleClick Ad Exchange, which was brought to China earlier this year, makes a significant amount of AdSense inventory available for us. As a data-driven advertising technology company, iPinyou can really bid on and optimize this huge inventory for our advertisers. This has changed the landscape significantly: before there were ad network companies taking advantage of the inventory they bought; with the RTB ecosystem, access to inventory becomes equal to everyone. What makes a difference is the data-driven audience buying technology.

What are Ipinyou’s sources for supply?

iPinyou source of supply comes from two places. One is direct purchase from publishers. The dominant purchase method is CPM (We are pushing very hard on CPM in China!) The other is through bidding on ad exchange. We expect to see inventory from exchanges become increasily significant piece of our supply.

Do you have creative capabilities?

We are building dynamic creative optimization technology. We have a tiny creative service team because some marketers want us to help them on digital creatives. But we really like to be focused on technology and partner with creative agencies to serve marketers.

Where is the ad tech “hub” in China? And where are you all based -and how many in the company?

Like the U.S., there are two ad tech hubs in China. One is in Beijing and the other is in Shanghai. Major publishers are located in Beijing and there is a much bigger technical talent pool. Both Beijing and Shanghai are rich in advertisers. Ipinyou is headquartered in Beijing and have offices in Shanghai and Guanzhou. Most of our R&D is in Beijing. Sure. iPinyou has approximately 150 people in the company.

What would you say are the biggest misconceptions about the Chinese digital ad market?

Some terms from the USA are misused in China, which has caused confusion. For example, some advertising companies claimed that they have a DSP in late 2010. But the truth is that the first ad exchange in China did not exist until October 2011. Maybe they think any product which serves advertisers, thus demand side, can be called a demand-side platform.

Twelve to 18 months from now, what are some milestones you would like Ipinyou to achieve?

There are two big milestones for Ipinyou. One is its technology product offering. We will offer a full suite of advertising tools such as data management, dynamic creative, and yield management, either by our own development or through partnership, to better serve Chinese marketers in display, mobile, social, and video channels. The other is our high revenue growth. We expect a 3x~5x growth in 2012. We served over 50% of major ecommerce brands in China in the past, and this year, we hope to be able to expand our service to branded marketers such as auto, financial services, CPG and IT.

By John Ebbert (Adexchanger)

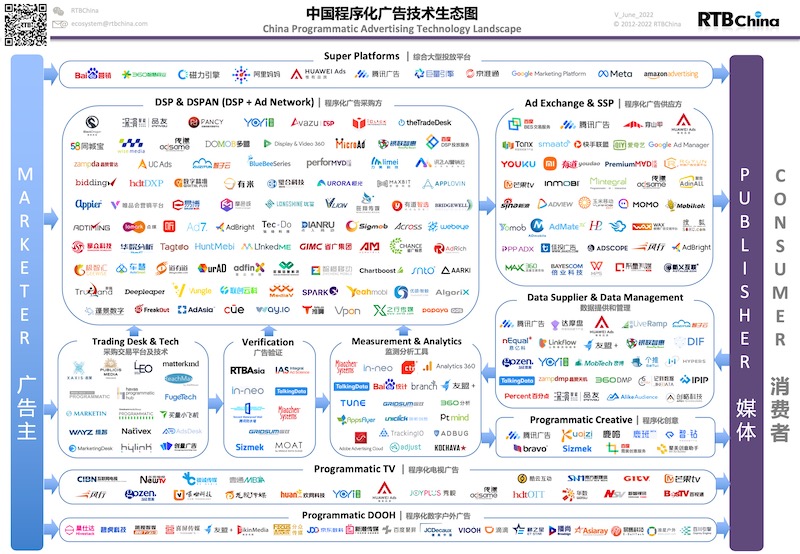

RTBChina

RTBChina